Introduction

The stock market can seem like a daunting place for beginners, full of jargon, fluctuating numbers, and endless financial headlines. But understanding how it works is essential for anyone looking to grow their wealth through investments. Platforms like FintechZoom provide valuable insights and tools to help individuals make sense of stock trading and market trends. In this comprehensive guide, we’ll explore the FintechZoom Stock Basics, covering everything from key stock market concepts to practical tips for new investors.

By the end of this article, you’ll have a clear understanding of how the stock market works, common strategies, and what to expect when diving into the world of investments. Whether you’re a beginner investor or someone curious about stocks, this guide is tailored to simplify complex topics and provide actionable advice.

What Are Stocks?

A stock represents a share in the ownership of a company. When you purchase stock, you become a partial owner of that company, entitling you to a portion of its profits (dividends) and, in some cases, a voting right in corporate decisions. If you’re curious about specific stocks, you can learn more by reading What Is FintechZoom Stock for a comprehensive overview.

Common Stock: Offers voting rights but may have fluctuating dividends.

Preferred Stock: No voting rights but typically pays fixed dividends.

Understanding stocks is essential for navigating the stock market since they are the primary financial instruments traded on exchanges like the New York Stock Exchange (NYSE) and NASD.AQ.

What Is the Stock Market?

The stock market refers to the collection of exchanges where stocks, bonds, and other securities are bought and sold. It’s not a single entity but rather a network of financial exchanges that facilitate transactions.

Key Stock Market Players

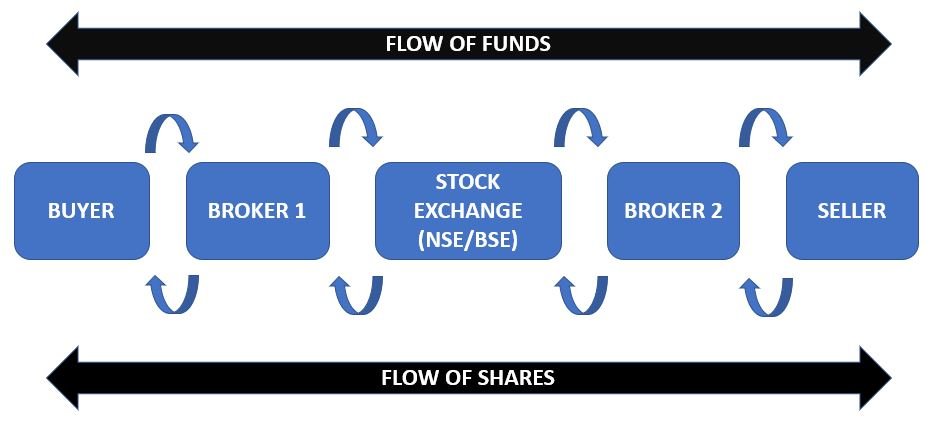

- Stock Exchanges: Platforms where buying and selling happen (e.g., NASDAQ, NYSE).

- Investors: Individuals or institutions who buy stocks with the expectation of returns.

- Brokers: Agents who facilitate trades between buyers and sellers for a fee or commission.

These components work together to ensure a functioning and transparent marketplace.

Why Do Companies Issue Stocks?

Companies issue stocks to raise capital for growth, expansion, or operations. This is called equity financing, which allows companies to avoid taking on debt. In exchange, shareholders share in the company’s profits and risks.

- Initial Public Offering (IPO): The first time a company offers shares to the public.

- Secondary Market: Where investors trade stocks after the IPO.

How Does the Stock Market Work?

The stock market operates on the principle of supply and demand. Prices of stocks rise when demand is high and fall when demand is low. Trades happen through various market participants, including retail investors and large institutional investors.

Types of Markets

- Primary Market: Where new stocks are issued.

- Secondary Market: Where existing stocks are traded among investors.

Example: If a company releases positive financial news, its stock price may increase because more people want to invest in it. Conversely, negative news can drive stock prices down.

Key Concepts in Stock Market Investing

1. Market Indices

Market indices track the performance of a group of stocks to give investors an idea of how the market or a specific sector is performing.

- S&P 500: Tracks 500 large-cap companies in the U.S.

- NASDAQ Composite: Focuses on tech stocks.

- Dow Jones Industrial Average (DJIA): Tracks 30 major U.S. companies.

2. Bull vs. Bear Market

- Bull Market: A period of rising stock prices, often driven by optimism.

- Bear Market: A period of declining stock prices, often driven by pessimism or economic downturns.

3. Dividend Investing

Dividends are regular payments made by companies to shareholders as a way to distribute profits. Many investors prefer dividend stocks for their ability to provide passive income.

Practical Tips for Beginners: Navigating FintechZoom Tools

FintechZoom offers essential market insights and tools that make stock investing more accessible for beginners.

Using FintechZoom Effectively

- Real-Time Market Updates: Stay informed about stock price movements and news.

- Stock Screeners: Filter stocks based on criteria such as performance, industry, and dividends.

- Educational Resources: Access articles, tutorials, and analysis to build your investment knowledge.

Common Challenges and Misconceptions About Stock Investing

1. Stock Market Timing

Many beginners believe they need to time the market perfectly to make profits. In reality, long-term investing often yields better results than attempting to predict short-term movements.

2. High Risk, High Reward?

While some stocks can offer significant returns, they can also carry higher risks. Diversifying your portfolio reduces the impact of individual stock losses.

3. Fear of Market Volatility

Volatility is a normal part of the stock market. Educating yourself and staying focused on long-term goals can help you navigate market fluctuations without panic.

Essential Strategies for Stock Market Success

1. Start Small with Dollar-Cost Averaging (DCA)

DCA involves investing a fixed amount of money at regular intervals, regardless of the stock’s price. This strategy reduces the impact of market volatility.

Example: Investing $100 monthly in a stock fund, whether prices are high or low, ensures you buy more shares when prices drop.

2. Research and Diversify

Invest in a variety of stocks across different sectors to minimize risk. FintechZoom’s stock screener can help identify high-performing companies from diverse industries.

3. Set Clear Investment Goals

Define your financial objectives before investing. Are you investing for retirement, a major purchase, or building wealth? Your goals will determine the type of stocks you invest in and your overall strategy.

Understanding Stock Market Risks

Investing in stocks carries risks, including:

- Market Risk: The possibility of losses due to market fluctuations.

- Liquidity Risk: Difficulty selling a stock quickly without impacting its price.

- Company Risk: Risk associated with individual companies, such as bankruptcy.

Minimize risk by researching thoroughly, diversifying your portfolio, and staying updated on market trends using tools like those offered by FintechZoom.

Conclusion: Key Takeaways for Beginner Investors

Understanding the stock market is essential for anyone looking to build wealth and achieve financial freedom. With platforms like FintechZoom, beginners have access to real-time data, analysis tools, and educational resources to make informed decisions.

FAQs, FintechZoom Stock Basics

1. What is FintechZoom Stock Basics?

FintechZoom Stock Basics is a platform or resource designed to help beginners understand the fundamentals of investing in stocks. It covers essential topics like how the stock market works, the process of buying and selling stocks, and strategies for long-term investing.

2. How do I get started with stock investing through FintechZoom?

To get started with stock investing on FintechZoom, you can explore their beginner-friendly guides, which walk you through the process of choosing a brokerage, understanding stock quotes, and making your first stock purchase.

3. What types of stocks can I learn about on FintechZoom Stock Basics?

FintechZoom Stock Basics offers information on various types of stocks, including blue-chip stocks, growth stocks, dividend stocks, and penny stocks. It explains the characteristics of each type and helps investors decide which might suit their goals.

4. Does FintechZoom provide real-time stock data?

Yes, FintechZoom offers real-time stock data, including stock prices, trading volumes, and financial metrics, which can help investors make informed decisions. This data is especially useful for active traders and investors monitoring stock performance.

5. How does FintechZoom help with stock market analysis?

FintechZoom provides various tools and educational materials that teach users how to analyze stock performance. This includes understanding financial statements, evaluating market trends, and using technical indicators to make informed investment choices.

2 comments

[…] to navigate the stock market. For investors looking to diversify their portfolios, understanding FintechZoom Stock Basics can be a great starting point. FintechZoom not only covers financial news but also provides data on […]

[…] Before diving deeper into the FintechZoom stock symbol, it’s essential to understand the role of stock symbols in the financial markets. Stock symbols, often referred to as ticker symbols, are unique identifiers assigned to publicly traded companies. These symbols simplify the process of buying, selling, and tracking stocks. To grasp a better understanding of stock market fundamentals, you can explore more about FintechZoom Stock Basics. […]